Debtors Anonymous Speakers

Recovery Stories and Share-A-Day Keynote Speakers

Recordings below are from Share-A-Day Workshops.

2016 NYC Share-A-Day Keynote Speakers: Katherine (19m50s)

(MC Tony C): It’s my pleasure to introduce our first speaker: Katherine…

Katherine: Hi, I’m Katherine. I’m a debtor and under earner and I’m recovering in this program it’s really great to be here it’s great to see all these faces and I have not been a regular New York City meeting attendee because one of the benefits of the program which I will mention actually is that I met and married a wonderful guy who lives in New Jersey so having sworn I would never live in New Jersey, I now attend meetings there.

I do have notes, I hope you’ll forgive me, but I wanted to make sure to share my experience strength and hope so. I’ve been in D.A. since 1996 which would make me a 20 year participant and I will tell you that DA has changed my life and that I am still a beginner.

It’s changed my life because it’s brought spirituality into a place that I thought it would never enter which was my financial situation and it’s also changed my life because my relationship to a higher power now includes asking for assistance and considering the higher power to be my employer as well as well my boss I guess in every possible way as well as my guide on a daily basis.

It’s interesting that the theme for today is carrying the message because I would not have discovered DA if it hadn’t been for a friend of mine who I knew to always have serious money problems and she told me about Debtors Anonymous. She actually told me about two years before I came into the rooms. I remember she was someone who was always losing her money and losing jobs and, you know, selling jewelry to quickly pay a bill and I remember she told me about Debtors Anonymous and I did (you know) my sort of best patronizing “Oh, that’s so good for YOU I’m sure it will help YOU!” Two years later I was calling her for the location of the closest and nearest soonest meeting that she could get me to.

So what brought me into DA? I’ve been self employed for many years but I had been at that point self employed for a probably four years and I had a recurring experience which was I would pay estimated taxes. I would file my taxes. I would go see my account and he would tell me that I owed two or three thousand more dollars than I’d already paid. I would be embarrassed I’d feel ashamed I’d feel furious and I’d find a way some way to scrounge up the money and pay that bill and then start the whole cycle all over again. So the third time that this happened it occurred to me that I should call my friend and actually I should first leave that accountant because all he ever said was you just need to make more money and I didn’t understand what that meant and also that my friend who was in debtors anonymous I knew that she was not experiencing this kind of torment. So I contacted her and I came into the rooms…and anyone who’s new to D.A., I will just tell you that I hated coming here initially. I had a headache every time I walked into the room. I felt like I had a big fat “L” on top of my forehead I was terrified to see someone I knew in the rooms and then as it turned out, of course, you learned that to see someone you know in the rooms is for me today is a wonderful sign because it means we’re both working on getting better. So when I first came in to D.A. I did what is now referred to as the – it’s now referred to as poolside DA (that means you keep numbers and that in my case it meant I kept numbers I did the tools that I wanted I attended one or two meetings a week and I ignored everything I didn’t want to do).

And then about six weeks six months into it, I lost my solvency there was an estimated tax payment due and I didn’t have the money. I freaked out I made phone calls and I learned that I had debted. And that’s when I got serious! That’s when I found a sponsor. That’s when I began working the Steps. So we’re talking about the Steps and Literature and Carrying the Message in my case and at that time it was in 1996-1997, around there my sponsor had me use the 12 & 12 of Alcoholics Anonymous and the Big Book and there were plenty of pamphlets for D.A. but there was not a real road map besides that literature. I love that literature, actually, and I will tell you that through working Step One, I learned that no matter how hard I tried to figure money out on my own, it was always, in the end, unmanageable for me. Something inside of me (I know I still can’t tell you what it is) somehow propelled me into finding the same problems over and over and over again with my money.

In working Step 2: Coming to believe a power greater than myself could restore me to sanity, my sponsor helped me see my insanity and in my case, because I always like specifics, I realized that I couldn’t allow myself to be paid very well by my clients. I realized that I had a compulsive need to give them discounts whether they asked for it or not I also acted as if I were a wealthy housewife because I would treat anybody who I went out to a meal with, give extravagant gifts I couldn’t afford and pay for my basics sometimes with credit cards.

I also learned that I had a sense of low self-esteem that required that I worked harder and harder and harder and harder because I had to prove to everybody how fabulous I was and I had to make you like me and all these things as you can imagine were very messy as far as money goes… so with Step Three, that posed the biggest challenge: Making a decision to turn my life and will over to the care of God as I understood him. That God… first of all, I had to switch my concept of God which I preferred a punitive Catholic God, (laughing breath) that I had nurtured for many years: who had a big spreadsheet in the sky and had plenty of things to punish people with – I had to change that into the loving presence of a higher power and I had to actually say, “OK, this higher power can help me with my money.” I never ever imagined that a higher power would care or could assist in this realm. I don’t know if anyone else feels that way but that was new for me and the way that I got to the Third step, actually, or that I practiced the Third step at least initially was through The Big Book.

There is a Third step prayer which many of you probably already know but I’m gonna say it because I recited this every single day for probably at least five years:

God I offer myself to thee to build with me and to do with me as thou wilt.

Relieve me of the bondage of self that I may better do thy will.

Take away my difficulties that victory over them may bear witness to those I would help of thy power thy love and thy way of life.

May I do thy will always.

Now – I’m not really into: “Thee’s Thou’s and Thy’s,” but what I found was that this particular piece of literature became like an anchor for me – because one of the things that I’ve learned in my recovery is that when I focus on being of service, when I focus on being guided, when I focus on sticking to the principles of solvency in self care and service, things continued to get better for me. So I worked the remaining steps with my sponsor (again using the 12 & 12 at that time) and Step Four in my case taking a fearless and searching moral inventory. She actually had me write the story of my relationship with money. There are many ways to work Step Four – that one was particularly interesting for me. And since then, I’ve done Step Four several different ways.

Then we proceeded with the rest of the Steps and covering the defects asking God to remove my shortcomings, making amends to people I’d harmed and I started praying and meditating regularly. All this I did using the 12 & 12. So through working the Steps and reading D.A. literature, my life continued and continues to get better.

I learned how to raise fees and that I would do literally by getting people (my PRG people) to write me a script, which isn’t literature exactly, but it became my literature. You know, they’d write a script for me and I would recite the script, and sometimes I’ve…I had the script right behind me so that I you know, in case I lost my words, my clients couldn’t see it. I learned how to look for more work for better business by getting out there and by looking at the literature. Actually, that is about being of service and thinking of myself as someone who can be of service, and that’s been a really interesting thing for me. You know, the emphasis of that theory, as it goes with our spiritual program, that whenever I was out to get something from someone, it never seemed to go very well for me. You know, because I was coming from this sort of Gimme…I need to take this, rather than, how can I be of service to you? How can we solve a problem together?

Since being in program, many great things have happened. Most specifically, one thing, actually, which is not a material thing, is that I’ve learned slowly how to reduce the compulsive tendency to over work and to have to prove myself to people, over and over again. I’ve also in my business co-authored and published four books. We’ve traveled all over the world and given workshops and been of service. Our company serves, has served, I think thousands and thousands of people. And all this happened because of coming to D.A., reading the literature and working with people who are willing to propel me to be of service in a bigger way out in the world.

Another thing that I did, another piece of literature I’ve enjoyed is the vision…you know, the things about Vision Pamphlets that talk about that those have helped me a great deal. (pause…)Twelve years ago (actually in an interesting way…through this fellowship) I met and (ten years after that I met or sorry. Two years after that, 12 years ago, I met, and then two years after that, I married a wonderful person, a wonderful guy. And actually what’s interesting about that is that’s another form of abundance that I never thought program would bring me. He has two children and I got to be a stepmother. And in through working D.A., I got to do the steps all over again. This was now as a married person, sharing money, sharing responsibilities and learning how to be forthright in that respect and still maintain my solvency. So one of the things that I’m doing right now is I’m working the Steps again. And I don’t know how many of you have this. The new the 12 Steps of Debtors Anonymous. Yeah, it’s fabulous. I highly, highly recommend it. One of the things that I think is really exciting about D.A. is that it keeps growing and it keeps developing. And I’ve done (read) Currency of Hope, which is also wonderful. But this particular one for me, has articulated: The First step, the Second step, the Third…the Steps in a way that I understand as a, as a person, 20 years in recovery, but also still a beginner. It touches me to the very core. And I’m right now, going back through grad school, and I say “back” because I already have a Masters.

That first Masters, I was able to earn a fabulous huge debt of a student loan, which I paid off very slowly. (In D.A. over many years). This year I’m paying as I go. And I remember people talking about that and me thinking, “You are nuts.” And yet again, through the help of D.A. and working the steps and using the literature, (one day at a time, one semester at a time), I’m now in my 4th semester of going back to school.

My recovery is far from perfect. I’ve lost my solvency a number of times. And I say that because (you know very often) when I came into DA, I was like, “Who are the winners here and how am I gonna be one of them?” You know (noise). So what I’ve learned is, it really is progress, not perfection, for me in this program. And I’ve also learned that. I can always return to the literature. I can always return to the tools of the program and have a better experience. Every time that I have lost my solvency, by the way, I’ve returned to the steps. And I’ve never gone out. (which I guess is also a common thing where you leave altogether and then come back with thousands and thousands more of debt). I’ve more had slips along the way, so usually those are the opportunity to retool and retread. And refocus and come back and come back to the basics. And for me the basics… (Thank you to Timer)…remain always: The Steps and the understanding of service and the understanding that this is a spiritual program.

I remember coming in to D.A. and someone saying to me: “It’s about the money, but it’s not about the money”. I thought that was a very Zen statement at the time. Now I really do understand that statement. In fact, right now, as I’m working the steps with a new sponsor and using this wonderful new book, I’m really focusing on my relationship to time and money. Because what I see for me is that I have a tendency to over give and be overly optimistic about what I can accomplish in my time.

And you know, the thing that’s fascinating again with the Steps is that you can see like a Fourth step inventory…you can see that your greatest strength is also your greatest challenge. So I’ve learned in D.A. that I actually have a very generous spirit. I want to be able to do all these things and help all these people and accomplish all these goals. And yet what I have to learn is, the spiritual being having a human experience is what my limitations are. You know, so what is good orderly relationship to time and money now? So that’s my current lesson now.

For those of you who are newer to D.A., I just wanna say first of all, welcome, welcome, welcome. You are courageous to be here. This is an amazing program. And it ain’t easy. And part of that is because what happens is people’s lives get better as they get busier and so sometimes to get service, to get assistance, to have get the help that you need takes real perseverance.

And I will tell you again, looking at the literature, reading the pamphlet about pressure relief groups and sponsorship and all that, and then thinking I’m gonna get me some of that, you know, wanting those things. What I ended up doing many times was turning that into a spiritual practice as well, where I would literally walk into a meeting and say a prayer, “Please show me the person who I need to ask for their phone number today. Show me someone who may be available as a PRG person. Show me who I might listen to and hear a message where I might then ask that person to sponsor me.” And I say that because it’s easy to get discouraged in a program where people are very busy and waving lots of tools around (laugh…) and telling you to get going and and you’re trying to get traction. But having a hard time finding the right help. And yet, if you hang in there and if you keep asking, it will come. That is something I’ve learned – that the right help and wonderful help will come. I also you know, as here I’m talking about being of service being of service and being of service. My relationship to service keeps changing over time and one of the things that I’m learning through my current sponsor is that I have to reduce the amount of times ’cause I always wanna say yes that I say yes. And I actually have to, in order to be sober in my service, keep remembering to use, also receive help and assistance, and to keep that on a balanced tread with the amount of help and assistance that I give.

So I live in New Jersey now. (I think I mentioned) and I run a business in New York and I’m going to Graduate School and life is full. (Thank you. ) And really abundant. And I’m still a beginner and I’m grateful for every single person here and every person whose path I’ve crossed in DA. This is an amazing program. It is a fabulous spiritual journey. HP will help with the money and I thank you for this opportunity to be of service.

(MC)Now let’s hear it again for Katherine. Thank you. That was great. (Applause)

2016 | NYC Share-A-Day Keynote Speaker: Nye (19m28s)

(MC) Now let’s bring up Nye.

Nye:

Hi, my name is Nye, and I’m a debtor. Great to be here today. Thank you, Katherine. That was, that was amazing. And so I’m a debtor and I’m coming up on – it’s for four years and nine months of solvency. Thank you, I did it all myself. Just kidding. So I came into, came into DA in 2008. And I really, really, really didn’t want to be a debtor, you know, I really, I didn’t didn’t want to be a debtor, and I didn’t want to have to do anything about money. Other than spend it. And, you know, I, it was actually someone not in DA, who first, like, put the bug in my ear for DA and it’s a great friend of mine that I’ve known for years and years. And she’s not in 12 Step programs, but she loves what 12 Step has done for me in other areas. And, you know, she kept hearing me, like, struggling with paying my rent, with overspending, with having creditors, you know, like, so she like, sent me an email saying, “Maybe you should check this out.” And it was a link to DA NYC to the New York Debtors Anonymous website. And I immediately emailed her back saying, “Thank you very much. I will apply the 12 steps of AAA in this area in my life.” Hit send. And, like later that week, I was walking out of the building out of out of my apartment building. And a doorman said, “Oh Nye, this came for you.” And I was like, and I took this envelope. And I looked and it was like a summons. And I said, “Oh, this isn’t for me.” It is for me. And it was a court summons of for a credit card debt. And you know, this was this, this was me. And this was this was like the I don’t know how many thousandth time that suddenly something was in front of me that didn’t, like didn’t compute. And so I remembered her sending that link and I thought, “Well, maybe I’ll check out a meeting.”

And you know, like, my, my dis-ease with money has like it’s been, I think it’s always been there. It’s it’s been there like, as long as I can remember the first time that I had interactions with money, like something wasn’t quite right. And the money was always something more than money. You know, it was love, it was security, it, you know, it like: feeling bad, spend some money, feeling good, spend some money, like money, money, money wasn’t money on some level for me, and I mean, when I was about 18. I was 19 – my dad and I, our names are very similar, the middle names are different. And the credit a credit card company had obviously made a grievous error and, and sent me a gold card with an $18,000 credit limit. And I like open this envelope and I pulled out the card in my name, you know: “You have you have a credit line of $18,000,” and I was like “What? Free money!” And that was when I was 18. So, this is years later and that and like, that didn’t end well.

And you know that like through throughout like my adult life like there was so many times that people around me, like with all the best intentions were like, “Let’s help Nye figure this out.” And you know, I got several really like close friends, several business associates like at different points had said like, “Oh let’s, let’s help Nye. Let’s figure this out. Let’s get you on a budget.” And I’d be like, “Okay, budget. Like, yeah.” And so we, you know, they would help me go through and look at, like, how much I owed, how much did I have coming in, you know, when were things due and we’d like set up this really neat budget. And I could do it so well for like, three days. Three days, maybe a week. But always at some point that budget didn’t make sense to me anymore. And, you know, like, what made the difference was being in Debtors Anonymous, and like having one debtor, speaking with another. It’s like, if, if somebody doesn’t have this thing, I don’t understand what they’re saying. And, you know, it’s, it’s like, it’s that, you know, yes. Like, I understand, yes, I’ve got that too. Like, and this is what I did. And that’s the only that’s the only thing that can possibly compute for me. And, you know, so I came 2008, I went running down Fifth Avenue with my hair on fire, and went to the Friday night meeting there. And so I attended the meetings. And it all seemed really odd to me. But at some point, there was a shift for me that I finally was like, okay, just, I’m just going to be a newcomer, I’m going to allow myself to be a newcomer. And I’m going to listen, and I’m going to try to do what these people are telling me.

And so that was, you know, that I was, someone told me to get a little notebook and write down everything I was spending, on any given day, any money I had coming in. I thought that sounded dumb. But I did it. And it was an actually, it was like through that action. Like that was that was like really the first time in my entire life, that suddenly I started understanding, like, Oh, I do this, and it causes this. And then this, there’s a direct physical manifestation to my spending. And then, of course, like, the extreme attic that I am, like, of course, I immediately then went into like, I’m not going to spend any money. And I remember sitting like, in the beginning, I was like, sitting in meetings, and somebody would have like a name brand coffee. And I think you better you with your fancy coffees? And yeah, that that didn’t last very long. But God but um, so of course, I went from one extreme to another. And, you know, the, it was suggested that I get a PR G’s or pressure relief group or pressure relief meetings. So setting with two other debtors, preferably a man and a woman with more recovery than me 90 days of solvency. And like that first pressure relief meeting, like that, completely, like shifted things for me, I had the my PRG man, I came into DA, and I thought I had $160,000 worth of debt. And that was with hours and hours of calculations before coming into dA like ours. And I thought it was 160,000. And within my first week in DA, and looking at the numbers, I realized it was $260,000, which is a big dip. That’s a big difference. And the pressure relief man was awesome, because I’ve like had this number that felt like, like, the impossible to ever deal with. And like we sat down, and he looked at it, and he burst out laughing. And he said, Oh, don’t feel bad. I was at 2.5 million. And that was oh, and he said that I was at 2.5. And that was 20 years ago. And so I was like, okay, maybe I don’t have it so bad. And it’s like, and you know, and if 2.5 100 whatever if that sounds like gobbledygook, like whatever my number is, is the number that feels insurmountable to me. So whether it’s 1500 or even zero and I don’t know when to do it still as as powerful as that 250,000 was for me. And so I had had my first press release meeting and that was and that was amazing. And as, as Katherine mentioned, I mean there’s there’s like so much here, like in Debtors Anonymous with our literature with sponsorship with pressure relief meetings with meetings with all our tools, and it’s like, there’s all this available. But then I like have to do it. And you know, and that’s, that’s really that’s where, like, it’s one debtor talking with another. And like, if I’m just in a meeting, and I’m hearing all this, you know, I can sit there in the meeting and think, like, Yes, I’m gonna do it, I’m gonna do it, I’m gonna do it, and then I get home, and it’s like, Netflix. And it’s, and it seems perfectly logical, because that’s completely insurmountable. And so, you know, my, my, my automatic reaction is okay, I won’t do anything. And, and, you know, because I need people for, I need people to help me get to a higher power, which is going to like, the higher my higher power does solve all my problems. But like, for me to, like, stay open, and have that channel to my higher power, like, I need you. Like, I can’t do this thing alone. I absolutely cannot. And, you know, sometimes, like, when I was doing da, you know, I sort of could sometimes feel like, like, sick, like, I was sitting there going, like, okay, hell, like, hello, hell, but it’s like, everybody’s like, as Katherine said, like running around with all their tools. And it’s your, and you’re like, ah, and, you know, and then and like, you know, we you sponsor me know. And, I mean, I, like, you know, getting a sponsor getting your pressure relief video, like, as mentioned, like, it’s perseverance and like, and it is, it is actually, like, it was super hard, like, in the beginning to like, set up pressure relief meetings, and you know, to find one man, one woman, that they have the qualifications, that they’re willing to sit on a pressure relief meeting with me, and that they’re available. At the same time that it works for me. And it’s like, as a newcomer, that was like, that was like nuts. Like, it didn’t like, it was impossible. And, and it can be super frustrating. But it’s actually part like, for me, it’s actually it is a spiritual action, like it’s showing up for my recovery. And it’s also and it’s like, you know, helping me have a voice ask for help. Look at my schedule, you know, like, approach people be businesslike about it in some manner that, that the people are actually able to fit in with my schedule. And, you know, in the same the same with sponsorship, I think I asked, ya know, I asked several people, and they just had no, and, and then I worked with, to two other people, and it wasn’t a good fit. And then, and then finally, like, clicked with someone. But it wasn’t like, you know, in, in some programs, it’s like, you know, I need a sponsor, and you have like, 20 people like surrounding you, like, I’ll be your sponsor, your sponsor, and, you know, sometimes, you know, because it’s, there is like, there is so much on offer here, but it’s not immediately obvious. And so, what else? Oh, so, the Catherine had mentioned both of these, and I just, I finished recently reading the currency of hope, the second edition. And it is amazing. I really, I absolutely adored it. And it is, it’s basically, you know, it’s how members of debtors anonymous found a solution through the 12 steps of debtors anonymous, through their higher power for their gadding problem. And it’s and it’s, it’s amazing, and I can, you know, find myself in some, you know, not another stories, but related to the feelings. And it was like, you know, I read basically I read one every morning for like, a month and it was just no I didn’t, I’m lying. I read two pages every morning for like a month. And, and it was really, really wonderful. And the, you know, for us to have they’re actually for debtors anonymous, not being that old as a program like we do have great literature at our fingertips and And, you know, the I really could, could relate so much in the, like the pamphlet on debtors anonymous when I was new, because it didn’t, I couldn’t really understand what you guys were saying in the beginning so much. But if I could be like, sitting reading it and having it described to me like, What is this thing? And what is the solution I could relate. So there’s the pamphlets, which are amazing. And our new book, with the 12 steps of debtors anonymous, and, like seeing those, I mean, the big book of Alcoholics Anonymous is awesome. And I so you know, I love it. And funnily enough, in there, there is quite a bit about money. In in The Big Book of Alcoholics Anonymous, there’s like whole, like, whole sections of it that are devoted to money. But to have like, our 12 steps, specifically on money and dieting is amazing. And, you know, the, the earlier, when I was in da, and I was using just, you know, just the big bug, it was interesting in there, because it says in the big book, like that the purpose of this bug is, I’m paraphrasing, but to connect me with a higher power that will solve all my problems today. And for years, I had always read that as the purpose of this book is to connect you with the 12 steps of Alcoholics Anonymous, which will solve all your problems today. Like that’s what my my brain had understood. And it wasn’t until like rereading it, that I saw that there that like, at the end of the day, the solution is my higher power. And like, however I get there, and, you know, debtors anonymous, is like, is perfectly suited to my disease in this area. And so like, when I’m able to be open, honest, and willing, in this area, like it all works out just fine. And, you know, my sponsor, like the, my, my reason for being here, at any given point, is like to help another second suffering debtor in order to do that, like, I have to stay solvent myself and be in recovery myself. And I know my sponsor really, like keeps the focus on staying solvent today, like not getting today, not getting no matter what. And, like, I don’t know how many times since we’ve been working together, that I’ve called with the reason I have to debt, like, you know, like this bills coming in, I don’t have any money and that the like, then it’s going to be late, and then there’ll be in charge. And he’ll be like, Okay, so is the bill due, when’s the bill due? And I’m like tomorrow, and he’s like, okay, so what can we do? And he’ll like, we’ll go through like how, like, what can I do to generate the money to pay the bill on time and to not debt. And sometimes we’ve had those conversations, like over the course of this, like one day, like in the morning, like, okay, and then the afternoon like, okay, nothing’s out. And he’s like, okay, it’s not over till it’s over. And I’m like and, like, if like, I keep my hand in my partner’s hand, and I keep taking action, it does actually all work out just fine. But you know, it’s like that having faith and accepts faith plus action.

Which ain’t easy, but you know, it does. It does. Everything does turn out just fine. And you know, so thank you so much for my solvency. Wonderful to be here today and wishing you all a great recovery.

(MC) Let’s hear it again for Nye.

2012 | NYC Share-A-Day Keynote Speaker: Rose (20m06s)

Rose:

Can everyone hear me now? Okay, thanks so much. So happy. So happy I’m here. Didn’t feel that way for a long time. I wasn’t happy about, certainly wasn’t happy about being a debtor and debting. It’s so funny, I came into the room and there was just a mic in the middle of the floor. A plain mic, this one. And it shocked me because I went to the meeting this morning and hiding. And I my first thought is with the podium. That I need to be behind something. So so. So how it is? Yeah. And my name is Rose, I’m recovering better. Hi, hi fellows. And someone said about, you know, telling your story. And I felt like I got, you know, different feelings about someone else says, “When are you going to sign off?” Like your story is interesting, but it’s not going to get you? Well, you know. So, I think because before I came to DA, I was in Al-Anon. And I had one of those four-star soap opera stories there. And then I came to Debtors Anonymous, and I didn’t have any much drama. Of course, I’ve been a debtor as long as I can remember, I never had enough money. I never had, as far as I’m concerned. I never had enough of anything. I didn’t have enough brains, I’d never have money. I didn’t have enough time. I didn’t have enough anything, whatever. Whatever it is. I my reading was, I didn’t have enough of it. You know, I wasn’t enough, and I didn’t have enough. And it’s all untrue. It’s untrue. For me central for everybody else. Everybody else has absolutely everything they need. Absolutely everything you need. You have already. It’s about I think it’s about getting in touch with it and releasing it. I was self-employed, I was self I came to this is my second trip to DEA. The first time I came and I stayed a few weeks. And I love I love three-word answers. And I’ve got it, I’ve got it, I got it. And I stayed a few weeks, I thought I got more in and out. That’s the whole principle, you know, and that is a principle and DA more has to come in before then you out. But that wasn’t the only thing. So things got worse in the short time when I came back and my impression of DA – I was so terrified of people, I was so afraid of them. And at the same time, I just thought they are so smart. They are so smart. But they are so scary. You know. And a few weeks ago, someone when I shared that someone said that I was scared to you and I cave goes around comes around goes around. So since I was self-employed, my biggest problem was the taxes and paying the government what was two and even lying, cheating stealing. I couldn’t do it. You know, I was keeping my numbers before I came into DA, but I was keeping the number what I tell you what numbers I was keeping. I was keeping the numbers of what went into My Tax Account. So that I wouldn’t report it to the government. But if I could find any way to get money that didn’t hit my tax account, but didn’t have my name involved with it somehow that those were the records I was keeping. What was mine. And what was mine? Great crazy, but that’s what I was doing. Back this my therapist that rose using your brains in the service of your neurosis course. You know the so good to say that. The second time I stayed and had had difficulty getting I was 57 When I came to GA so none of that means anything but just means it doesn’t matter when you come it doesn’t matter. When you show up at it doesn’t matter. It’s all so already taken care of. The only thing I had to do is go just show here’s the deal in life in everything is just showing up showing up. And you don’t really have to do much more than that, you know? So

having a pressure meeting. It’s all it’s all very scary. Scary about meeting with people talking about money. I made first impression meeting was years ago in the Tiffany diner. And I was ordering coffee. Not that I wasn’t hungry. I didn’t have money to pay for Bill. So I was having coffee, you know, that’s the story of and, and trying to look, I think I spoke to someone just this last week. And I said to him, you know, thank you. So I know from GE, I think he’s so smart and so recovered. And he says, I put on a good front. And I thought, well, don’t we all? Isn’t that the story, especially in trying to look good, you know, no money and in debt, but trying to look good. I think that’s, that’s the deal in the DA. So that’s the deal of the disorder. That’s the deal of the disorder, not being honest about who I am and how I am. And what’s what’s really real, you know, trying to look. So just wanted to say, How am I doing the time, Allison?

Okay, great. Thank you so much. I spoke to someone this week about, you know, someone had asked me to speak weeks ago, and I said, Yes. And since then, I’ve been thinking, Why the hell did I ever say? What I say would do it. But you know, I said, I would do it. Because, you know, because it’s the right, it’s the right thing to do, and to do what you’re asked to do. And then I was very sick last week, and I thought, maybe I’ll be hospitalized, you know? Maybe, maybe, you know, I say yes, but maybe I can get out of it. And say one of my things too, is I like to look good. When I’m in my illness, you know, I can be sick. I mean, you know, really mentally ill, but you know, trying to look good at the same time, you know, very important, very important. So it’s about letting go all about letting go of that. Just letting just letting things be just, you know, the in the first step and the 12 and 12. It says, you know, if we’d looked at our history, you know, years back would show us that we’d had a problem with before our realization of our dad talked about the alcohol problem, but years before, this was just not a habit. It’s become a progressive disorder. And years before I was, I was always in trouble with money. And, you know, when somebody told me when coffee was 10 cents, I had mine. And you know, and years ago, and the New York City bus system, the coffee was 13 cents, 13 cents, and the speed machine on Queens would go in and and. And I got on the bus, I had 12. So I said to the driver, as quiet as sort of voice as possible. Could I ride for 12 cents, and he’s got the machine going, he’s making all this noise. This is why just say what to say. couldn’t, couldn’t say it again. I could, I said it once, I couldn’t say it again. So some guy hands behind me puts a penny in my hand. But that’s that’s just how this disorders, that’s just how this disorder is, it’s like, then as I go on, and larger amounts of money that I don’t have, you know, years ago, long before I came to DEA, long before I came to DEA, I owe the government like $200 I didn’t have to go to Dallas. So I just threw the form away, you know, I went to the tax guy who did it, you know, and I look, I’m going to tax me and get my taxes. Right. But I didn’t have the money. So I threw the form away. And just, you know, dealt with that later, you know, things things get worse. And then that’s the progression and progression. There’s recoveries progressive to you know what I mean? I’m not the person that was weeks ago, I’m not the person that was months ago and that recovery is progressive as a disease is progressive. And there’s, you know, it’s so much about the mind thinking, the disorder is a disorder. You know, the big book says, you know, resentment is the cause of spiritual malady. It says self centered fear is the cause. Someone else says that a sense of separation from your creators cause probably all that doesn’t matter. Really doesn’t doesn’t point the causes doesn’t matter. Just what it just matters is what I’m going to do to really heal from from from this malady that I have. I love build use the word malady a lot, you know, certainly mal adaption to this existence to this life and to dealing with money, you know. So one of the things in the big book, it’s beautiful in the back of it, is it you have to get to the back to read it. It says that they have the answer. They absolutely say that they have the answer to every problem. I will meet today they have they absolutely say that they had the answer. And they said, acceptance, acceptance is the answer to every problem I have today. Every problem doesn’t say approval, doesn’t say appreciation, doesn’t say anything about what the problem is, it just talks about not resisting it. Non fighting, and just accepting that accepting and accepting the fact of the that I had, I have got it. And I know someone else who says, Whatever you can be with whatever you can be with, can be transformed. Whatever I’m willing to be with can be changed, doesn’t mean that I can change it. But it means that there’s a spiritual program here. And it’s a power greater than myself, not me, but a power greater than myself, can change it.

There’s a certain amount of willingness that’s needed. And am I willing, this person that I heard a couple of weeks ago said, you know, would I chair? Would I dare to be not damaged? You know, what I dare to be? My God, I don’t know. What the What the thought makes me stop and think would I do to be, you know, I’ve been posting lots of ways this damaged a long, long time. And maybe some of them were true. But that was a long time ago. And a lot of things have changed. But it’s a great thought, it’s a great question, Would I dare to be, and would I dare to be who I was created to be, instead of what I’ve created.

What I do to be by myself, I can. My willing to, I’m willing to step up to that we have a will. And we can do two things with it. We can assert it, I know how to do that. Not very well, but I’ve done it. And or I can surrender it. That’s what I have, the choice is like my will, I can assert it, or I can surrender it. You know, and I don’t have to surrender it to, you know, to the crazy figures I’ve had in my life, I surrender to a power greater than myself. So and let let things change from from that from that view. So there’s a Chinese master, and I’ve been reading some of his stuff. He’s so very wise. And he says he has three jewels that I thought, well, if they if he thinks these things are jewels, it must be pretty important. And the first one he said is, merci, merci. No. And I think of the very first 12 Step phone call I made many years ago was long before I came to DA. And I called up a lady and I was in Al-Anon, you know, a couple of weeks. But I knew what I was going to do. What I was planning to do was absolutely antithesis what they were saying in that room. So I called up this lady, I don’t know. Well, I know, I know. I called her because the grace of God, I called it this lady and I spoke to her and she said her answer was, I can’t tell you what to do. But whatever you do, I’ll talk to you Tuesday night. So wonderful, because it meant I could go back. Because what I would do in the past is I would I would not go back because I would feel a guilt, you know, guilt, the shame, the two silent killers guilt and shame. And they keep us from from life, from living life. And so then extend mercy, to extend mercy to myself, for what I’ve created with my illness. The homeless, I’ve created the harm sector and extend mercy to others I can use for you. Everyone’s in the same row on the same bus your kids to no one at all, just varying shades of the same. Thomas Moore, this may sound off of the same people but I love it. He said and he was going to his his death. He said, we’re all in executioner’s cart, on the way to execution who could be angry or upset with another and then but it’s like this is where we are? A Frankenstein 123 We’re all in the mess in varying degrees. Thanks so much. Inmates are getting out of the mess. And the second treasure he spoke about was frugality. Now, that’s not a word that appeals to the frugality. No, but but, but I think it really means living within what you’ve got living with what you’ve got. And I retired five years ago, almost six. And I don’t have what I used to have any anyway. So I do the deprivation. To me, I live a deprivation lifestyle, someone says, Well, this, discuss that with southern Afghanistan, you know, you might discuss your deprivation lifestyle with someone in Afghanistan, you know, but this is where I am, you know, but you know, but I’m not working. So I live, I live on my head. And I make do with what I have. And I and I, through the grace of God don’t that through the grace of God, by myself, I don’t have that capacity, that this couple of years ago, if I only had a credit card or credit card, but I don’t have a credit card, and thank God I don’t. And, and the third treasure is humility. And what happened. And humility is another beautiful quality. It says, priceless, the book is priceless. Wednesday night, I said, I was gonna sit on a PRG at 5:30 L. Ron was 31st Street. And I was talking to some ladies before the meeting. And so if someone go down the stairs, someone I opened the men to for many, many months. But I wasn’t going to the first meeting, I was sitting on the PRG at 530. And when the PRG finished, I said to the pressure man, I said, you know, there’s someone in that room that I would have been talking to, he said, “Well, you could go on to 30th Street exit.

And don’t think I didn’t think of it because I was saying, I was talking of course we’re always talking to ourselves. And it’s a big conversation going on, you know, constantly. So I really didn’t know what I was going to do. Because like the pain, the pain taught by humility, the pain of the embarrassment of going for someone and owning up to haven’t been crabby. So just didn’t hold up my end. And I went into the room, it was a lot of people, a lot of people milling around, I started talking to someone else, see, because I still want to look good. When I’m not when I’m sick. I started talking to someone who said, Oh, I came in here because I have to make an amends to somebody and, and they say, oh, you know, like, it’s a good thing. Because I’m not going around making the man I’m not gonna talk to someone else about then I couldn’t find the person. And so, but I called him the next day, and still want to look good. I said, you know, I didn’t go into the meeting looking for you. I was like, me, how honest Do you want to get you know, like, how so and but I didn’t make the amend. And we had a nice conversation, you know, but that’s that, you know, it’s growth through growth, the humility to do that. But, you know, taking on the humility part doesn’t, doesn’t always feel so comfortable. But I feel so much more comfortable with myself. I don’t have to judge that person and have to cross the street when I see them coming. I don’t have to feel uncomfortable at a meeting. You know, it’s just so I’m so glad for that. And before signing off, I want to thank you years ago, I made a nun. And she was with the order from Mother Teresa. Always the back of digital. And her name was sister Anna wiem. I never heard of the word. And the word means the little ones. The little ones means like the ones who pick the fruit that we once we never see. People would never see it. And I always think of that when I’m going by a grocery store and I see a little guy carrying up a carton of something, you know, I’m walking by and I’ve seen guy come up the stairs. I think the and we and I’m not saying this in the sense because in the sense of anonymity, everyone’s equal. You come in, you’re equal. There’s no one better. There’s no one greater. There’s no one lessons. This is all a scope of debtors. And but like the people who put this on who can’t look about the fellowship tab and who got here early, you know, who ran workshops with the people we don’t know. The people will won’t know the names who don’t see what they do. We don’t know what energy they put out. But I really would like just to give a recognition to all those things.

2012 | NYC Share-A-Day Keynote Speaker: Alan (19:30 Min)

Hi I’m Alan A, I’m a compulsive debtor…(Applause)

And let me just start by saying that my anniversary is July 14th, 1990, so 21 years of solvency today. I’m sitting up here thinking I don’t wanna do 21 years. In 20 minutes, that’s. But I’ll try to keep it short. I want to start by talking about where I am now actually. Because where I am now is in a very different place than when I came into the program. But I I’ve I’ve had a job. There’s a near the microphone. Thank you. Oh. That better. OK, even closer, like right on the mic. Somebody gonna catch a cold from big. I’ve had I’ve had a job for 19 years, almost 19 years would be 19 years. In February 3rd, a job that I got through this program that greatly increased my income, and in the beginning of December I walked into my boss’s office and I turned in my resignation and I’ve decided to become self-employed. Which I started in January and I used to occasionally go to the meetings at 12 W 12th St, the self-employed meeting and and to me it was like sitting among aliens. I never could quite understand the desire to be self-employed to start with. Why would you want a salary, you know? The idea of being in a position now where I have to generate my own income, which is like the scariest thing in the world for me, is what I’m doing now. But the question that that kept coming back to me, that became really clear the more I looked at it was why am I not self-employed? Because my my income has become much more complex than just the salary. I started earning royalties back in 2006 and those royalties have greatly increased my income and and are enough to do to survive off of and to thrive off of and and to work more on my own and be independent from the company I’ve been working with. So it became really clear that this is, this is the next step for me and this is what I needed to do and this is tremendous change for me. But at the same time, I was just sharing in a meeting that I was packing up my boxes, packing the stuff from my office and and the end of December and you know, I emailed everybody to give him my new e-mail address and I. Took all the things off the wall and put them in boxes and I closed up my laptop which belonged to the company and I put it in the drawer, left them I know where to find it. And then I took the two speakers for the laptop that I used company money for and bought years ago. I took them, put them in a box to take home. And it took just as a little. There’s a little gap, about 15 minutes, where all of a sudden I suddenly stopped and I said, wait a minute, I’m stealing the speakers. 21 years of solvency and I’m still stealing speakers. It was amazing. But they the miracle, of course, is that I was able to stop myself and look at it and say, whoa, what the hell is going on here? You know, isn’t that weird? And that’s the miracle of the program. And the disease doesn’t go away. The disease is still there. The the desire that I have to have to get something for nothing is. It’s a lifelong desire. I still love a free lunch. I still have a hard time leaving a hotel room without that urge to take the shampoo. You know, all of those things are just a very, very strong part of of how I approach survival in my life. And thanks to this program, I’m able to walk out of the hotel room without the shampoo. I’m able to walk out of the office without the stamp speakers. And one of the things I had to set for myself was to go by. New speakers, you know that I needed to do that because because I can afford it. I I have. I have a spending plan. I can buy my own speakers. I don’t have to steal them, you know, to have speakers.

As I said, it came into this program 21 years ago in 1990 at Saint Mary’s. I think it was Saint Mary’s Church. Yeah. And, and I was very fortunate that that I’m somebody who came into the program at a bottom, complete bottom. I was making $23,000 a year and I had a I had a debt of 35,000. Once a year and and that that picture just in itself to me, spells and sanity. How can you possibly pay back $35,000 if you’re making 23,000 to raise a family of three? Not even for just me, but three people. And it just that was not working. And so I I had a pressure meeting fairly early because I was two months behind on the rent and so there was a very serious possibility to get kicked out on the street with an infant at home. And so I pushed for a pressure meeting early on. And one of the earliest things that they said to me is they, they, you know, we looked. We developed a spending plan. They looked at expenses, they looked at the money coming in, money going out and basically said you need to make more income. Now the thing that’s interesting to me when I stop and I think about that is from the perspective of many in DNA today that would be addressing under earning. You’re an intern, or you need to make more money so that you don’t debt. But that’s not really what they told me. They didn’t say make more money so that you know that. What they told me was don’t debt. And while you’re at it, make more money so that you can increase your expenses. Was my expenses were so low that it was it was difficult just to go to a movie if I wanted to to eat out if I wanted to to do any of the simple things to give gifts was was impossible unless I did it and and and So what I had to do is I had to stop at it and then I had to deal with the deprivation in some way and the idea was to make more income so that. It deprived myself less, because the more it deprived myself, the more likely I would dead again. And that was the basic premise behind them. So I could have, I could have dealt with my under earning from the perspective of not under earning and therefore I want that because I’m making more money and that’s that. You know, I wanted something for nothing. It was it wasn’t just that that I had today was because I I chose to death. I preferred the debt. Because when I did it, I was using somebody else’s money instead of mine. And I like that. I like that a lot. It it took the edge off of of of of the money I was making. There was, it was, it was like the safety safety valve from the that that if I used somebody else’s $1000 to buy things, I didn’t have to use my own $1000 to buy things. And I had great appeal to me. And I have to confess that, you know, the truth is that when I did it, I I never really thought I would pay it back. I was through the lottery, would pay it back. Yeah, there always be some way to pay back. Maybe, maybe I’d inherit some money. Yeah. But but it was never me paying it back on the regular basis. There was always getting something for nothing and and this is just something that, you know that that carried for years and and and and so clear to me as a matter of fact, I oftentimes like to put it as, as, as as a compulsive indebtedness. So I got the compulsion for me is never you think it’s always been hard for me to relate to the the concept that compulsive debting is I never imagined myself like like a drunk with a bottle of of Scotch that that I would take that card and go, oh, I’ve got to use this card, I’ve got to use this card. It was never that kind of compulsion, but rather it was it was that I always was more comfortable. Being indebted to somebody else, rather than taking care of myself to get money from my parents, for example, was much more appealing than having to make my own money to to borrow from a credit card was much more appealing. To use their money was much more appealing. I remember years ago I told the story before that there was an article in Mother Jones magazine about. The writer who had used credit cards up and down the California coast and and managed at the end of it to not have to pay any of it back. And I remember thinking, I want that that’s for me and that that that’s the way I viewed life. Life was that you tried to get away with something and tried to get something for nothing. And I and I can’t think of a job that I’ve ever had where I didn’t try to steal things from that. Employer. You know, there was always something that I would want to take, and again it was that urge to get something for nothing.

So one of the first things that happened with me in the program is I had to, I had to start thinking of ways to increase my income again to take that, that, that, that edge off. And and I started doing some little odd jobs. I started tutoring students in English. I started doing reviews of of proposals that people would send into a publishing company. And several of the things that I started doing and and they started to push out my income a little bit and took some of that edge off. At the same time, I was dealing with creditors and I did a debt moratorium. And debt moratorium to me was absolutely crucial for me. Again, if you’re making $23,000 and you’re $35,000 in debt, something has to give. Something has to give. And as you know in this program when we look at spending plans, the creditors are at the bottom of the list. And there’s a reason for that because we take care of ourselves first and then we take care of our creditors. And a lot of confusion I oftentimes see over the years is, is that you know, somehow DA, our goal is to pay back our debts and that’s not our goal. You can look at all the literature, and it doesn’t say anywhere in our literature. Then do what you can to pay back all your debts. What it says is don’t incur new unsecured debt one day at a time, starting today. And and that’s the commitment and and it’s no matter what and that and that’s the hard part that no matter what. So even though I was making $23,000 a year, I had to stop dating. And that meant dealing with a lot of pain, a lot of pain, a lot of pain came up around that. Then a lot of deprivation and then having to face that, that I was allowing myself to live in that kind of deprivation. And and yet at the same time not getting. And it made calling up each of my creditors and saying I can’t pay you anything now. You know, making $23,000 a year, I cannot pay you right now. But I I’m like a, like a, like a a repeated recording. I would keep saying to them, I take full responsibility for this debt. I have every intention of paying him back. But today I cannot pay you anything. And I’ll contact you again in three months and I’ll let you know if my situation has changed. And then I have to call them again in three months and did the same thing and I put it in writing with the with the certified return receipt on it and kept the record of that. And eventually after a year and a half, I was able to start paying back my creditors on my terms, not on their terms. They weren’t happy with what I paid them back. I I would pay them one dollar, $5, whatever I could. But it was according to what my pressure meeting came up with. They would say, OK, your total debt repayment is $50 for this month. So you divide it up evenly among your creditors, you know, according to how much you owe each one. And that went on for years and years. And I finally paid off my my last debt, which was the student loan. I paid it off and at 13 years. Took 13 years to pay it off. Now that of course if it’s irrelevant because the fact that I paid it back, it didn’t pay it back is irrelevant. But that’s what I would like applause for is that I didn’t get for those 13 years that that’s, that’s, that’s. Because that’s what matters. That’s what matters is the not dealing. What it does is it gets you your feet on the ground and you suddenly have this real, authentic vision of what living without debt is like. That’s why we call it solvency, at least those of us who still call it solvency. And that’s another unfortunate thing that we’ve lost that word. Living solely one day at a time doesn’t mean living without debt. It means living as if yourself and one day at a time. What does it feel like to be debt free today? And if it means doing it, that moratorium, then that’s what you do in order to feel that, but not getting one day at a time. And for me, the program is just amazing and it’s just amazing the things that happened to me.

I made $23,000 a year. At that time I the highest I imagine myself making was 35,000. I had this this clear debt seal that seal steered clear ceiling on how much I can make that if I made $35,000. And I’ve been pretty good shape, which is absurd. I’m imagine a family of three in New York City, $35,000. That’s how crazy I was. And and even though that was 20 years ago, it still doesn’t make any difference. And what ended up happening is that one of those jobs that the ways that I figured out to make extra income ended up leading to the job that I had for the last 19 years and that was the publishing company that I was doing. Doing reviews for it. And they like the reviews I did. They approached me and said would you like a job? And and they ended up offering me, well, they said they were going to offer me 50,000 when I had the interview and then when they actually offered the job, they offered me 45,000. Now being the terrified debtor that I was, I was almost ready to just accept that and say, Oh well. They took 5000 off. You know, that’s what I deserve. But I spoke to my sponsor that and he says, well, how much do you want to make? And he tried to get me to ask for 55, but I didn’t have the guts. So I asked for 50 and they said yes and I got the 50. And and that that very slow change of mentality is something that you know took time, the ability to ask for what I wanted. You know, to to, to to think through what you know what what is, what is the value of what I do and how much should I be asking for? It was was something that took time. I remember a couple of years later getting to a point where I was ready to ask for a raise because I started talking to other publishing companies and it became really clear that that I had something of value that they wanted and and that I could make more money doing it. But. I decided I didn’t really want to change companies, so I came to this point overtime where it became clear I needed to ask for a raise and it took me 3 months of talking to my sponsor before I had the guts to ask for it. That’s how painful it was and when it when the time finally came to do it, I had to call my sponsor. I book it and he told me literally to take baby steps into my boss’s office. And to ask for that raise, no matter how I felt last Friday, because I was terrified that I would humiliate myself, that I get shaky voice and, and to me, humiliation is like the biggest thing that gets in my way of doing anything. And he said do it anyway. And so I trusted him. I just, you know, I over the years, I’ve trusted the actions that my pressure people give me and my sponsor gives me And just do them anyway. And I remember walking into her office like this. And I I took the baby steps and washed my feet and I went in and and actually got shaky voice, at least at least from my perception I was shaky voice. And I asked for it anyway and she said OK. And and it’s it’s been amazing if I found that you know much easier to get those things than than I ever imagined it would be. Because there’s so many issues that I carry with me, so much baggage I carry that gets in my way and the bottom line is the ability to to take actions anyway. No matter how I feel to take actions anyway. And the way to get there is just by moving forward. You know that that that’s why we continue to have pressure meetings because pressure meetings help us to keep moving forward. It’s like an incredible tool that keeps us, keeps us going that way instead of getting, instead of stagnating and stopping. I’m, I’m a, I’m a great procrastinator. I’m going, I I procrastinate like nobody. And and and. The only way I get through that is by is by consciously working the program. You know, working the program and going to pressure meetings and working and taking actions and doing it. No matter how I feel about it, even if I feel crappy about it or afraid to do it anyway. And all kinds of things happening. I bought a house with the help of this program. Thank you. I never thought that was possible. I thought that my credit rating would be so shot after all the crap that happened with my creditors. And by the way, I forgot to mention, I went to court three times. I I had my wages garnished at one point, I had my bank account frozen another point. Those are very painful and scary things to go through. And what I could have done is said, well, that’s too painful. I’m not going to do that. I’ll throw some more money at my creditors. But what I learned from the program is that you don’t get no matter what. So that means that even though you go into court, you don’t debt and you show up in court, you take the action and show up. And the first time I showed up in court was actually amazing. It was in Queens and it was the first thing in the morning. And I was the first person to come into the courtroom and there’s nobody in the room and they and the only thing on the wall. Was it was. It was the words in God we trust. And I mean to me, I’ve always been very frightened by that because I always seemed very feisty, sort of right wing kind of thing. We’re seeing those words at that moment a whole different meaning and and and that’s what I did. I just trusted and and I remember I ended up talking to A to a it was a like an arbitrator, a pre pretrial arbitrator who who just kind of said can you do $40 a month and I thought about it and $40 a month was more than I had been paying up until that time. And I said, well, OK, I’ll do that. And my income happened to go up about the same time that I was able to do $40 a month. And every time one of these things happened, I got whatever I needed to be able to do it. And debate will survive. Same thing with buying a house. I got, you know, getting a promotion right before I bought the house. But the amazing thing is I remember talking to A to a mortgage broker. And I decided to be rigorously honest. And when I spoke to him, I said I just want you to know I defaulted on my student loans back in 1990 and I I think my credit rating is not going to be that great. He says, oh, let me check. He disappears and comes back. He says you have an excellent credit rating. and i think it was because i was in contact with my creditors for all those years and i showed up and i and i i acted responsibly and regularly with them and eventually my credit rating cleaned up and i was able to buy house you know so so all the all the fears about what if this happens what if that we’re getting

And regularly with them. And eventually my credit rating cleaned up and I was able to buy a house, you know, so, so all the all the fears about what if this happens, what if that happens? What if I get a bad credit rating? What if this happens what and all of those things that that that I needed to set aside and say I’m willing to debt, not debt, one day at a time, no matter what. And and that that’s the bottom line. The other thing I mentioned too is I’ve benefited tremendously in this program through visions and and yet visions are the smallest part of my program. The smallest part, my primary purpose in this program is to not that one day at a time visions of the extra. That’s the extra that I get out of the program. And one of my visions, first of all, getting that job, this job to begin with, it surprised me because I had actually written down kind of a vision about what I wanted to do my life, and it surprised me how how well the job actually matched a lot of the things I’ve written down. But years later, I was in my boss’s office one day for review and she said, what do you see yourself doing in five years? And I said, you know, you want the honest truth. And she said, yeah. And I said, well, I see myself being the author of a blockbuster English as a foreign language course. And that kind of publishing that we did was English in English as a second language and. Which is really isn’t that interesting. How can we make that happen? I said I don’t know. So she thought of that. She couldn’t think of any way to do it either, so it kind of dropped it. But I was interested in that. She encouraged me that. I found that interesting. But four years later, an opportunity came up and that’s what I ended up doing and ended up writing this course. The course brought in last year brought in $14 million for the company. So it’s tremendous, you know, it’s tremendously successful as a course and and we did a second edition of it last year and I I negotiated a double doubling of my royalty for the second edition and that’s that’s what I’m going to be living off of at the beginning of being self-employed and I’m about to be contracted with another publishing company to work on another course. So you know, visions that can be very, very powerful. But again the the main thing you get of the vision is what you get a pressure meetings which is moving forward and taking actions. But the bottom line, the bottom line and I’ll say it again is not debting one day at a time no matter what. Thank you. Thank you. (Applause)

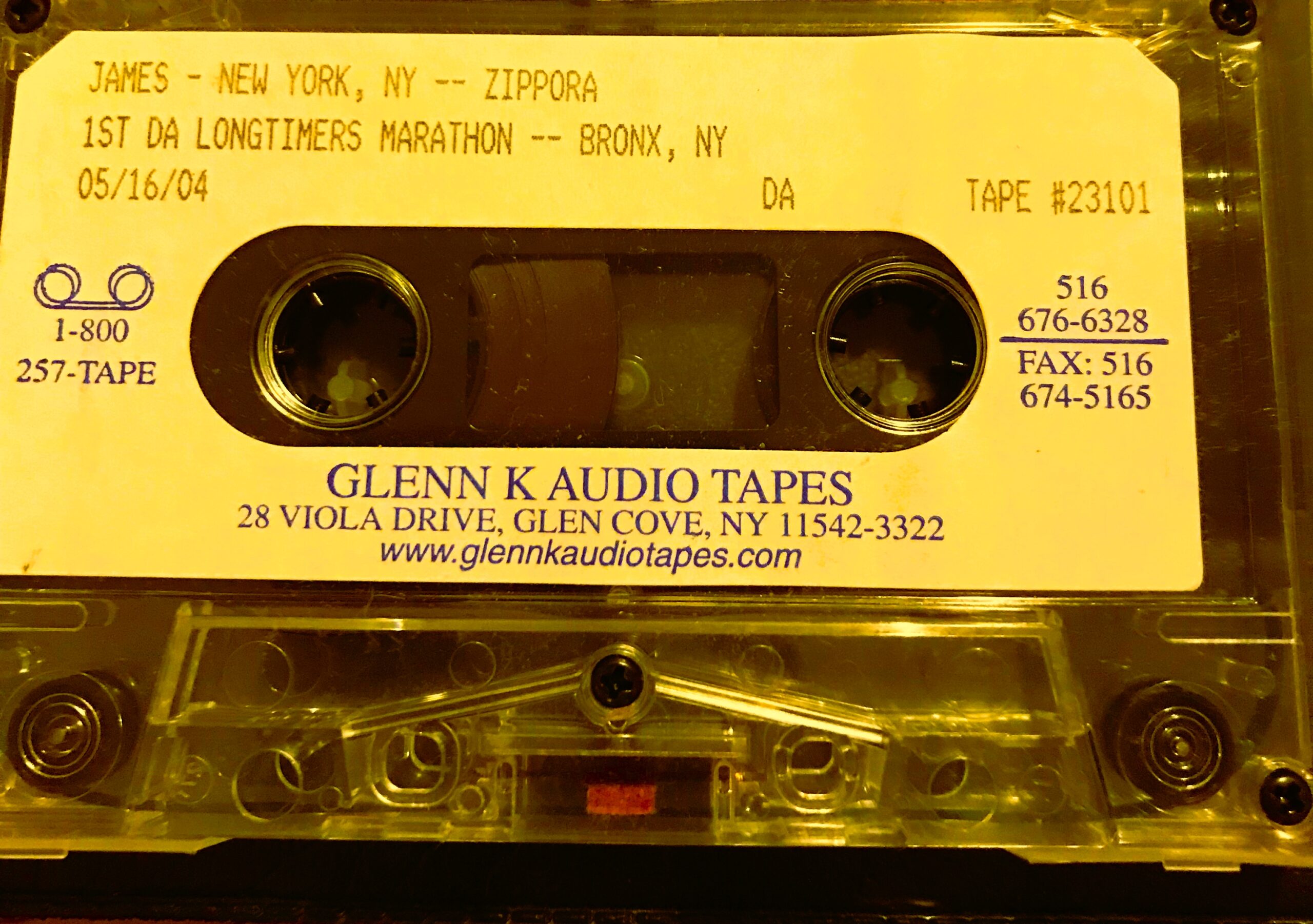

2004 | First DA Long Timers Marathon – Keynote Speaker: Zipporah (26:11 Min)

Title: Hello, my name is: Zippora…I’m a debtor.

Date: Unknown

Length: 26m:11s

Location: DANYC

Zipporah (D.A. Speaker)

(Auditorium applause)…

Applause)…Thank you. It’s the first time in my life I’m speaking to a microphone. Hi! (giggle)…And, that’s OK… And that’s OK.

I left my homeland, Israel. On, February 12th, 1981. And I was running away from a Kingdom(?) that I had. Because, my poor husband was very, very sick. Manic depressive. And three times had a gun to my stomach. And I decided I couldn’t do anything to him. He was a good man. He really loved me, but he was very sick. And I was pushing it again and again, not wanting to leave.

I had a very big job in a big computer company. I was assistant to the Vice President marketing. I’ve been in the company for 10 years. They were my home.

At home, I had three married children. I had one little grandson. And I just couldn’t. Um. My husband lost a lot of money. A lot! I had a very good salary and for the six years before I left I was taking care of him and the household. And whatever I needed to take care of.

But then my life was in danger. I went silently and confidentially to the President of the company. And I said I’m going to run away.

And he said: “I’m going to call you a traitor!

And, I said, you know what? You call me: “A Live Traitor, not a Dead Patriot. How about that?”

He said, you know, I’m sorry, and he hugged me. He gave me a letter of recommendation, highly recommending me, and so on and so forth. And I left.

The only money that I had at the time is a life insurance that I cashed in. I had $4,000 cash in my hand and I went (ran away) – to London. And the reason is that one of my technicians, my software manager, was in our sister company in Great Britain. And I was invited. They didn’t know what was going on. They knew something was terribly wrong going on. And they’re very Orthodox Jewish family. Very, very orthodox.

But they say: “We don’t care.” Our home is your home if you need – we’re here for you forever. So, God is good to me. I ran away. I stayed there for about six months. And all my money was gone. Couldn’t get a job. And I was now even more scared to go back to Israel. So I got a visa to America. And three days before it expired, (I didn’t wanna come here. It’s a barbaric country here. Not for me. Me? Who am I? But anyway…I), I had no choice.

I came here and I came here and God is – all the time – taking care of me. Somebody bought me a ticket. I had two friends. I had a couple of friends in Rockland County, Spring Valley, (NY state) and I had a couple of friends in Los Angeles. And they were fighting between them where I should come, where I should stay. Both of them wanted me. I’m lucky, you know. But I had no money to buy a ticket. So, I had a friend that I made in England. And he said I will get you money. And he got me money.

The money lasted for one way ticket to New York, and I had $15 in my hand. That’s it. And I came to New York. And in my Passport, I had the letter of recommendation tucked away. And guess what? The immigration found it. I didn’t know what I was doing. It was devastating. They took away my passport. They took away my belongings. They said they’re going to deport me immediately back to Israel, and if I did not get a heart attack or a stroke right there, I said I Will Survive. Another time and another time. And that’s what my life is about. All the time. Surviving, surviving, surviving, surviving.

To cut a very long story short. It took a long time. I got a job. They were willing. I am not an illegal person. I cannot be anywhere; Illegal. I’m too scared. Not because I’m good, it’s because I’m scared.

And I found a university that was willing to sign my papers. Which means that I was legally allowed to work illegally. I got a fake Social Security number. Everything went through the Labor Department. Not one day did I work and not pay tax on and whatnot. So, what I’m trying to tell you is not that I’m wonderful, what I’m trying to tell you. And all through my life. I always. I’m a Debtor that always paid my dues on time and before time and did everything that I need to do. Only, every time – something happened, and I was surviving again and surviving again and surviving again. For the next four years in America, I was being paid $3.40 an hour. And work from 8:00 in the morning till midnight six days a week. They would have made me work seven days a week, but it was a religious university, and they don’t work on Saturday. So, I couldn’t do that. I rented a sofa in somebody’s apartment, $450 a month. And I took home. From the university 11:00 o’clock at night, 10:00 o’clock at night at pile of applications of students to check their tests. Because I was also giving tests in Hebrew.

And I will sit and do that on the staircase and lighting all the time they. Because I had nowhere to go (do), but…When they sent my papers to the Labor Department, the Labor Department sent it back to the university. And said: “the lady is being underpaid! (Me, Underearning? [chuckle…] Wow, what a concept…)

…anyway. The Secretary of the University called me in and said, listen. We wanna help you. (Of course, …they’ve had me for three and a half dollars an hour). We wanna help you. I’m going to put in the record that we’re giving you more money, but you will sign now a letter that you will not demand this money from us. So, I signed the letter. That’s OK. Anyway, after four years, I got my green card. And, uh, I said. Thank you. And goodbye.

All these things I’m telling you because. I can tell you here we can sit…Probably a week. And I can tell you around the clock how many times…I survived.

I’m like a Phoenix. I burn down and I get up from the ashes…I burn down,…I get up from the Ashes – and that’s it.

(So, as soon as I got my papers…)

The reason that I’m saying it is because I have so many, so many Reasons. Good reasons. To be resentful. To be respectful (resentful?) about a million things. But it’s here. Right here…is where God saved me. Not to be burned. God taught me, right here, that the resentment is killing me. And it’s very difficult, very difficult to forgive…and not carry resentment.

In two situations: number one, because it’s not justified, it is not justified, and I’m the Lady of justice. On the other hand. How can I forgive this (these?) people? Another round of things…in 1995, I was working in New York, for Israeli/American company. The biggest industry in Israel for 10 years. And in 1995, October 15, they fired me after 10 years because, it took them 10 years to realize I don’t know how to work. And they pushed me out three years before retirement. Which means I’ll have to be in the D.A. for the rest of my life! Because I have no income to live on.

…My pension should have been $2,000 a month, (at least) net for the rest of my life and it is today $1,020. My rent is $1300. So that’s it. For three years I was looking for a job and sending resumes. I think there is not one office in New York City that doesn’t have my resume. And I couldn’t get a job. At that time, I was about eight years in another program, In Al-Anon…and I met somebody in Al-Anon that kept telling me: “Go to D.A.! You gotta go to D.A.!” I said: “Shut up!” How long do you think I wanna be in Al-Anon? It’s enough. She kept telling me, telling me go, go, go.

And I did.

(In November) 6 1/2 years ago, this November…I started going to D.A. and I realized that D.A. is a very rigorous and vigorous… Al-Anon program. The first time in my life. I Learn. That I’m important. And how to take care of me? And even today, till today, it’s difficult for me to waste time on me. I did my nails. Oh, I have no time. What do you mean you have no time? I’m here to take care of ME! In any case. I started going to D.A. And three years, how do you think I paid my rent? On credit cards.

I came to D.A. And in December, on December 1st, I started counting days. And I’m today solvent: six years, five months, and 16 days!

(Rounds of Applause)!

And if I want to tell you? Every week I used to say it’s not gonna last, it’s not gonna last, it’s not gonna last. But I had no choice. I had to keep going. I had to keep coming back.

The other choice was to commit suicide. And I’m not joking. I am very tired. Very tired and a lot of times very angry. But I’m here. And I’m very honored to be here standing before you. Because I know I carry…not a message of hope. I carry a message of miracles. Not one many. Many!

I lost my job again. I got (through) D.A., a job…that was paying half of what I used to get. And I said, but I can’t take this job. And somebody in the program said, “You don’t say No to money, you just go. Just go!” And I went and it was a horrible first year in the job! Horrendous…(Holocaust), I cannot even tell you.

But I kept going to D.A. I kept going to meetings. I kept getting service. I kept getting pressure meetings. I kept doing my spreadsheets from day one! I have spreadsheets from Day One!

I don’t know how…I…I hold onto the solvency and the numbers and the spreadsheets – exactly like a lifeline. And I am not kidding. I sound sometimes like a control freak (ha-ha). Which I am probably, but I know it saves my life! I know I just need to be solvent and to: write my numbers down. That’s all! And then I have to go to meetings because…my friends are in the …my family, not friends are in the meeting. My family is in the meetings and if somebody of them I don’t like…I immediately say: Principles Above Personalities. How many times I see somebody, I wanna spit on them. And I said, forgive me, God, I say I love you. I love you. I bless you, I love you, I love you, I bless you until I fall in love with them. And you know, it’s not because of them, it’s because of me. Because I need to change. I need to learn a Different Way.

The question every day again and again is: “Do I wanna Live or do I wanna Die?” As simple as that.

At the end of one year in my job…(pause) It was impossible – to work there – Again! Anymore! I say! (I speak a fever? to you anyway,)….with everything, with the help of D. A. every step, I do not…(pause) I’m very smart. And many times I’m very tempted to do things by myself. (pause) No! I always ask. I may hear the same thing that I was thinking. OK. Then it says, OK, you were thinking right and sometimes I’ll get a different answer and it’s OK, there is a different way. Always opens more doors and more and more doors.

So, at the end of one year, I told my boss:

“Listen. I am tired of you. You treat me here like chopped liver and I’m tired of that.”

(…and I was sure… immediately in my head…) I have my pressure people. I will immediately get together with them. I’ll immediately get together with my sponsor. They will help me. They will not pay my rent. But they will help me see another way.

(told my boss…) And I told him: **** you. Not-using that word, but I said: “Enough with you. I am tired of your behavior towards me and I am not going to take it anymore!” And I was sure that I’m going to be fired that evening. And I will make plans with my people what to do next and how to survive again. Guess what? He didn’t fire me. I came the next day – back to work. He was my Angel. For the next five years we were the best of friends. He sent me so many times on trips and vacations and his Irish to Ireland. I know Ireland inside out. Unbelievable. (pause)…to castles!

I took my grandson. (A treat that should have cost about $9,000 dollars. And I was ready. I had the money, I had D.A.! I paid $1,500. I went to the castle; I stayed in castles for 10 days in Ireland in all the castles. So, he’s still my friend. But. His place burned down. In July last July. And again, I’m looking for a job.

And again I say, now what am I going to do? So again, I’m holding on. I’m having my poor $1,000 income and I get Unemployment and that’s not enough! And God says I’ll put you even to a stronger test than that. (I’m telling you; this is amazing.) And what did God do to me? He sent me Bush! (probably “President George W Bush”)

(Some audience laughter!)

And Bush decided that those who have Unemployment, (even though I’m a Travel Agent and I’m entitled to almost two years of Unemployment.) that those who cut(?) their six months of Unemployment between December 28 to the 31st are gonna be cut off. And that’s it.

That’s me. So I’m cut off after six months.